Top 10 Electric Vehicle Manufacturers in China

Background Check

Longyuan supply professional and honest service.

We perform a background check on the manufacturers and make sure that these manufacturers comply with the regulations in China.

Every company we work with has to meet this background check and comply with all of the standards that we require.

For car manufacturers,suppliers or trading companies,we will identify them before cooperation.

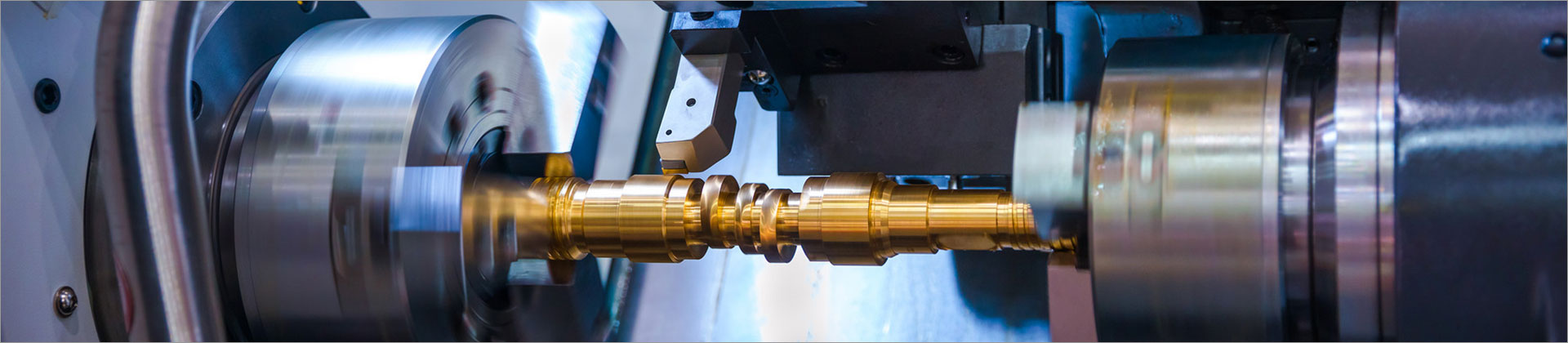

Manufacturing Capabilities

We make sure to inspect the manufacturing capacities of the manufacturer and see in what conditions these models are assembled.

If the manufacturer does not have the latest and greatest capacities, we just do not work with them. Since their manufacturing process does not meet the standards of the industry.

This is why we only work with the best manufacturers that can deliver really solid products.

Quality Inspection

We make sure that the product they deliver is good and there are no defects across the models that can result in expensive repairs.

Quality is the top priority that should be considered with every manufacturer out there. If the quality is poor we will take notes on the problems.

Ev Stocks Checking

We also check how this company suits financially. Notably how their stocks are evaluated and whether or not this company has a future.

Since how investors are reacting plays a huge role in what a company can or cannot do financially.

Best Product Price

We make sure that we find the best product for the price. This is our motto, if we don&#;t get the product for a good price, we don&#;t get it at all.We just make sure that this is the product you need and for the right price!

Negotiation And Contracts

Negotiations are crucial when it comes to any purchase, especially when it comes to purchasing of electric vehicles.

That&#;s why we are doing all the negotiation and contracts for you. So, you don&#;t have to deal with these aspects and focus more on the product.

For more information, please visit chinese ev companies.

Additional resources:United States Electric Scooter Tires Market by ApplicationLEAF SPRING vs COIL SPRINGSafe Payment

We offer safe payment methods. Our buying process is fully transparent since everything is placed in the agreement.

So, you should not worry much about this aspect since our main goal is doing business and have very satisfied customers.

Best Logistics Solutions

We have one of the best logistics in the industry. We move products more than anyone out there with great success.

We make sure that we deliver the product as fast as possible without delays for maximum customer satisfaction.

Best Guidance

During the whole process, we offer the best guidance. We have many experts in this field that have been doing this for a really long time and they will make sure that you never have any issues whatsoever.

The Chinese EV Dilemma: Subsidized Yet Striking

These additional kinds of funding are cumulatively substantial, with low-cost credit and equity investment likely being the most impactful for EV makers. Growing subsidies to battery makers may mean an overall shift to greater relative support for them.

There are at least two different ways to interpret the data on industrial policy support for EV makers. China&#;s trading partners could point to 15 years of sustained regulatory and financial support for domestic producers, which has fundamentally altered the playing field to make it much harder for others to compete in China or anywhere else where Chinese EVs are sold. By contrast, defenders of China could point out that the data show that subsidies as a percentage of total sales have declined substantially, from over 40% in the early years to only 11.4% in , which reflects a pattern in line with heavier support for infant industries, then a gradual reduction as they mature. In addition, they could note that the average support per vehicle has fallen from $13,860 in to just under $4,800 in , which is less than the $7,500 credit that goes to buyers of qualifying vehicles as part of the U.S.&#;s Inflation Reduction Act.

Although both perspectives have potential merit, I lean toward the former for three reasons. First is the cumulative effect of 15 years of state support and the likelihood that our data still do not account for other elements of industrial policy aid, which would translate into a higher subsidy rate as a proportion of overall sales and per vehicle.

The second is that even after all this time, there are 200 EV producers in China, who collectively have created far more capacity than the domestic market can bear. Not surprisingly, production has expanded rapidly, leading to growing inventories. As a result, firms have engaged in a bitter price war at home and expanded efforts to promote exports. According to the International Energy Agency (IEA), in &#;China used less than 40% of its maximum cell output, and cathode and anode active material installed manufacturing capacity was almost 4 and 9 times greater than global EV cell demand in .&#;

And third, despite the extensive government support and expansion of sales, very few Chinese EV producers and battery makers are profitable. In a well-functioning market economy, firms would more carefully gauge their investment in new capacity, and the emergence of such a sharp gap between supply and demand would likely result in industry consolidation, with some mergers and acquisitions, and other poorly performing companies leaving the market entirely.

In this context, given Chinese EV makers&#; scale and reach, it is difficult for other countries&#; producers who face tighter budget constraints to effectively compete. My guess, though, is that the endurance of these subsidies is unlikely part of an intentional plot for global domination of this industry and instead a byproduct of China&#;s inefficient industrial policy system in which support typically extends too long and is spread overly widely, a pathology visible in both tradable and non-tradable industries.

Striking Quality

If Chinese EVs were pieces of junk, then they would not be a serious challenge to the rest of the world&#;s automakers. For many years Chinese auto firms languished far behind the global trendsetters in Europe, East Asia and North America. But Chinese firms have narrowed the gap in autos in general and moved ahead in EVs.

There certainly has been substantial technology transfer through the joint ventures that China has required since the mid-s. Although China formally removed caps on joint-venture (JV) equity ratios held by foreign companies in , according to the American Chamber of Commerce in China, foreign producers in reality face difficulties in gaining a majority share of their JVs, buying out their Chinese partners, or establishing new wholly-owned subsidiaries in China (with Tesla being the most notable exception). That said, recent progress has been led not by JVs, but by independent private Chinese firms, including BYD, Geely, Great Wall, NIO, Li Auto, and XPeng. They have developed their own engineering and design capabilities as well as benefited from the guidance of global auto consulting firms, and overseas partnerships, such as Geely&#;s ownership of Volvo. Equally important, the move from internal combustion engines (ICE) to electric motors has radically reduced the technology threshold, making it possible for start-ups from the information technology (IT) sector to make a splash. And so, although there is a long tail of &#;also rans,&#; companies with low-quality vehicles, China&#;s leading automakers have made enormous strides and can&#;t be pegged as copycats or be relegated to the lower end of the market.

Independent auto analysts and Western automakers with whom I&#;ve spoken all agree that Chinese EV makers and battery producers have made tremendous progress and must be taken seriously. The energy intensity, range and reliability of Chinese EV batteries have risen significantly in the past few years, while the overall design, infotainment systems, and autonomy capabilities of Chinese models have advanced.

Such progress was visible in trips the Trustee Chair team made to China this Spring (see Figure 4). With their green-shaded license plates, EVs accounted for a high proportion of cars on the road in every city we visited. Showrooms featuring a wide range of brands were usually crowded with curious shoppers. Factory visits were even more revealing. Battery makers Gotion (based in Hefei, Anhui) and SVolt (headquartered in Changzhou, Jiangsu) have huge plants that are highly automated, which they claim translate into low error rates, improved quality, and rapid production. Both produce batteries with a range of chemistries, have built multiple facilities around China and abroad, and engage in extensive R&D on solid-state batteries and other potential technologies.

Want more information on BMW Ix3 Supplier? Feel free to contact us.

Comments

All Comments ( 0 )