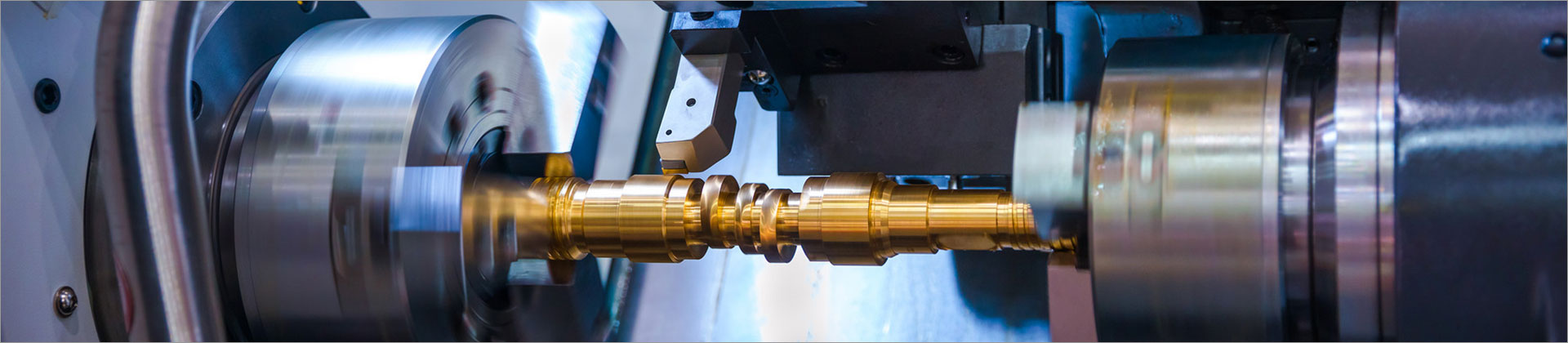

DY piston rings supply professional and honest service.

How Does Car Insurance Cost Work?

Car insurance is an essential requirement for anyone driving a car. The cost of car insurance is determined by several factors, including the type of car, the driver's age and gender, driving history, and location. Understanding how car insurance cost works can help drivers make informed decisions when purchasing insurance and save money while staying protected.

Factors that Affect Car Insurance Cost.

1. Type of Car: The type of car you drive affects your car insurance cost. Sports cars and luxury vehicles tend to have higher insurance costs than family sedans and compact cars. This is because high-performance vehicles are more likely to be involved in accidents and cost more to repair or replace. Insurance companies also consider the cost of the car, the safety record, and the likelihood of theft or damage.

2. Driver's Age and Gender: Insurance companies charge different rates based on the age and gender of the driver. Young drivers under the age of 25 and elderly drivers over the age of 65 have higher accident rates and tend to pay more for insurance. Male drivers also pay higher premiums than female drivers due to their higher accident rates.

3. Driving History: Your driving history is a significant factor that affects your car insurance cost. Factors such as the number of accidents, tickets, and driving violations on your record can increase your insurance rate. Drivers with a history of accidents or violations are considered high-risk by insurance companies and may pay more for coverage.

4. Location: Where you live also affects your car insurance cost. Drivers in urban areas with higher traffic and crime rates may pay more for insurance. Rural drivers typically have lower insurance rates since they encounter fewer accidents and have fewer thefts.

Ways to Save on Car Insurance Cost.

1. Increase Deductibles: A deductible is the amount you pay out of pocket before the insurance company covers the rest of the cost. Increasing your deductible can significantly lower your insurance cost. However, be sure to set the deductible at an amount that you can afford to pay out of pocket.

2. Bundle Insurance: Bundling car insurance with home or life insurance can often result in a discount from the insurance company.

3. Shop Around for Rates: Insurance company rates can vary widely, so it's essential to shop around and compare rates from different insurance companies to get the best deal.

4. Drive Safely: Maintaining a clean driving record with no accidents, tickets, or violations can help you qualify for lower insurance rates.

5. Take Advantage of Discounts: Many insurance companies offer discounts for drivers who take driver education courses, have safety features installed in their cars or are members of certain organizations.

Conclusion.

In conclusion, understanding how car insurance cost works is essential for every driver. Your car's type, your age, driving history, and location are all factors that determine your insurance rate. However, there are ways to save on car insurance cost, such as increasing your deductible, shopping around for rates, and maintaining a clean driving record. By taking advantage of these tips and making an informed decision when purchasing insurance, you can save money while staying protected.

Contact Us.

If you have any questions about car insurance or want to get a quote, please feel free to contact us. We're always here to help you find the best insurance coverage for your needs.

If you want to learn more, please visit our website.

The company is the world’s best piston ring price supplier. We are your one-stop shop for all needs. Our staff are highly-specialized and will help you find the product you need.

Comments

All Comments ( 0 )